The Prosper Card is an unsecured credit card issued by Coastal Community Bank, a member of the FDIC, under license from Mastercard International. Founded in 2005 as the first peer-to-peer market lending platform in the United States.

or

Prosper is based on a simple idea connecting people who want to lend with those who want to invest. Since its inception, Prosper has helped over a million people access affordable credit, with over $20 billion in loans issued through its platform.

Prosper’s lending strategies have been driven by ML (machine learning) models since 2015 and continue to enter new areas with proven performance and scalability. The Director role was recently created to create machine learning models for our credit card business.

What Are The Prosper Credit Card Registeration Steps And Stages?

First of all, when using the card, you will have to register at www.prosper.com with the appropriate prosper credit card in order for it to work. The registration process is divided into different phases and there are different steps involved:

- Visit the official website at www.prosper.com.

- On the screen of your computer, you will see an entirely new page appear.

- You will see an option in the right corner below the Prosper Credit Card Login button.

- Click on the Register Now option.

- The redirection will be made to the registration page after you click on the button.

- Here you will be asked for some details.

- First, you will be asked to enter your email ID.

- After that, enter the requested details like name and SSN number.

In the end, after successful registration, you will receive a confirmation email from the official Prosper Credit Card Login portal.

Steps To Follow Login Procedure

In the event that you have successfully registered on the correct credit card login portal, you will be able to access the official account Prosper Credit Card Login page very easily and quickly.

- Open the official Prosper Credit Card Login website at www.prosper.com.

- Click on the Prosper Credit Card Login button.

- On your screen, you will see the opening of a new page.

- Enter your Prosper Credit Card Login username and password that you received with your registration confirmation email.

- Finally, click on the Next button.

- You now have access to the real Prosper Credit Card Pre Approval dashboard or homepage.

After logging into the official Gap credit card login website, you can enjoy all the benefits and services of the portal.

Mandatory Prosper Card Login Requirements

Prosper has certain requirements for people who want to borrow money. You must meet all of the following conditions to be eligible:

- You need to have a FICO credit score of 640 or higher in order to qualify.

- You should have a debt-to-income ratio below 50% in order to qualify for this program.

- An income of $0 or more per year is reported as your reported income

- It has been 12 months since you filed for bankruptcy and you have not filed for bankruptcy since then.

- The number of credit inquiries on your credit report in the last six months should not exceed seven.

- The number of open credit accounts on your credit report should be at least three.

Different Features Of Login

- High APR. It is not a good card for those who have a balance. It has a variable APR that ranges from 23.99% to 29.99%.

- As a new member, you won’t be charged any annual fees for the first year that you join. The Prosper Credit Card Reviews gives you the option to have the card for one year without paying the $39 annual fee.

- charge foreign transaction fees. Please refrain from using this card for international travel as there is a 1% fee on all transactions made outside the United States.

- Fair or better credit is required. The credit score you have should be above 640 in order for you to have a good chance of being Prosper Credit Card Pre Approval.

Login Benefits Of Prosper

- It is advised that you have at least a $3,000 Prosper Credit Card Limit.

- Starting at $500 and going up to $3,000, with an automatic raise check every six months

- Fraudulent transactions are not liable for any damages

- Mastercard Zero Liability Protection protects you from unauthorized charges on your Mastercard account

- Resources available in terms of finances

- Courses and content are provided to you for free and exclusively.

- In the area of fraud prevention, there are many functions that must be carried out in order to prevent fraud

- Protection against fraud is achieved through the use of technologies

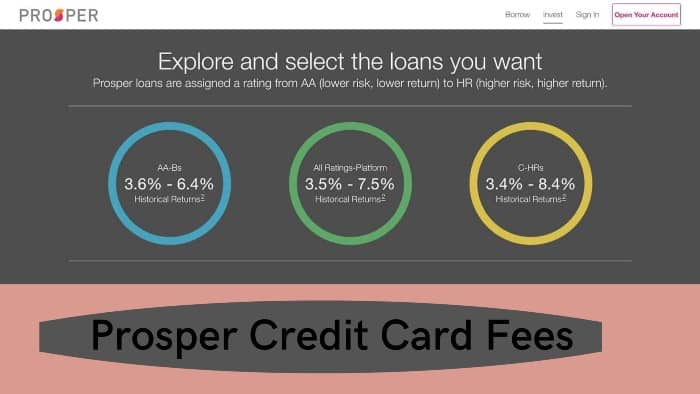

What Are The Prosper Card Loan Rates?

My order was $3,000. But only $2,850 was deposited into my checking account, exactly $150 less than what I requested. Why haven’t I received the full amount?

The commission Prosper took on my loan was 5% ($3,000 x 5% = $150) as an initial commission. It is usually a matter of 2.4% to 5% of the loan amount that borrowers pay as a processing fee, depending on their creditworthiness. Before accepting your loan, be sure to check the interest rate listed at the top of the terms page to ensure it is what you wish to receive.

Note: If you need a specific amount, please consider this setup fee before applying. For example, suppose you need a loan of exactly $5,000. Assuming a 5% setup fee, you need to borrow $5,264 from Prosper. 5% of $5,264 is a fee of $264, leaving you with the $5,000 you want.

Details Of Mobile App

Know The app features given below:

- Check your balance and available funds and view or download monthly statements.

- Instantly view your digital card and start transacting online while you wait for your plastic card to arrive in the mail.

- View and search transaction activity.

- Make payments and edit or cancel outstanding payments.

- Lock or unlock your account to prevent further purchases or cash advances.

- Add your card to Apple Pay to use it for in-store purchases on eligible devices.

- Activate a new card or report a current card as lost, stolen, or misplaced.

- Use the trip notifications feature to ensure uninterrupted use of your card while traveling.

- Log in to receive notifications about your account.

- Prosper Credit Card Login with FaceID/TouchID.

Prosper card payments can be made online, over the phone, through the Prosper mobile app, or by mailing the card back to us. You can pay a Prosper Card invoice online by logging into your online account and finding the pay button within your account.

In this case, you will be able to choose how much you wish to pay when you wish to pay, and from where you wish to pay. Cardholders are also able to set up automatic payments with Prosper by logging into their account.

| Official Name | Prosper Credit Card |

|---|---|

| Portal Type | Login Portal |

| Managed By | Prosper |

| Language | English |

| Country | USA |

Ways To Make A Prosper Card Payment

By Phone: Dial 1-800-903-4697 (Monday through Friday, 8 am to 8 pm ET) and enter your card information when prompted.

Online: Log into your online account and look for the payment button.

Via the mobile app: Log into your account and select your card, then select the payment button.

By Mail: Send a check or money order (but not cash) payable to Prosper Card.

DUST. PO Box 650078, Dallas, TX 75265-0078.

Submit on time so it arrives by the due date. Also, write your credit card number on the check.

About

Prosper is a Better Business Bureau accredited company and has received an A+ rating from BBB, a non-profit organization focused on consumer protection and trust. The BBB rates companies by measuring companies’ responses to consumer complaints, honesty in advertising, and clarity of business practices.

Prosper was accused by the SEC in 2019 of miscalculating returns and misleading investors with its returns calculations. According to the SEC, investors are being enticed to invest more because of exaggerated annualized net returns. A settlement was reached between Prosper and the government, in which $3 million was paid.

For the sake of ensuring equal opportunity for all candidates, we do not discriminate on the basis of race, color, religion, marital status, age, national origin, parentage, physical or mental disability, health status, pregnancy, genetic information, sex, sexual orientation, gender identity or expression, veteran status, and any other status protected by the laws of any state, province, or country. However, we do allow applicants of color, ethnicity, or social classes to apply. Prosper will consider qualified applicants from non-US citizens and offer green card sponsorship.

Prosper is not the only personal loan provider. You should look around. The following are some things you need to take into account if you decide to compare them. One of them is interest. Lower interest rates are better for you because your loan costs less. also means low

Frequently Asked Questions

Does the Prosper credit card have a cashback or rewards program?

No, there is no rewards program offered at Prosper Credit Card Pre Approval.

What advantages does the Prosper credit card offer?

It offers the following benefits:

- Zero liability in case of fraud

- Reports to major credit agencies

What are the relevant APRs for the Prosper credit card?

- Based on public information provided by the Federal Reserve Board, the average APR is 15% for all credit cards and 17% for prepaid accounts. This card has regular above-average APRs.

- The Prosper Credit Card Reviews has a variable APR that ranges from 23.99% to 29.99%. It also has a variable cash advance APR of 29.99%.

Does the Prosper credit card offer an introductory APR for deposit transfers?

No, there is no introductory APR offer for balance transfers.

Does the Prosper Credit Card offer an introductory APR offer for new purchases?

In the case of new purchases made with this credit card, there is no introductory APR available.

Customer Service

Prosper is available to answer your questions from 6 am until 5 pm at Prosper Credit Card Customer Service, seven days a week, at 866-213-6663. The meeting will begin at 5 p.m. PT. You are welcome to attend the meeting or contact Borrower Services by calling 866-615-6319. If you would like to contact us via email, please send an email to www.prosper.com or at Prosper Credit Card Customer Service.

Conclusion

Prosper is a great personal loan provider for anyone looking to take out a loan and doesn’t want the proceeds to go entirely to the banks. Prosper Credit Card Reviews counts One complaint we have about Prosper Loans would be the time it takes for the money to reach you.

If you need a personal loan right away at Prosper Credit Card Customer Service, Prosper can’t help you. Otherwise, the peer-to-peer setup and flexible loan amount give you an edge over the competition.