Prosper’s advantage comes from experience and convenience. A big factor that has helped the company maintain an A-Plus rating from the Better Business Bureau is that it has been around for a longer period of time than any other P2P lender.

Its lenient requirements also open the door for many consumers, and its pre-approval option lets you see what interest rates you qualify for without hurting your credit score. For lenders to be able to make an immediate profit, they commonly charge fees on personal loans.

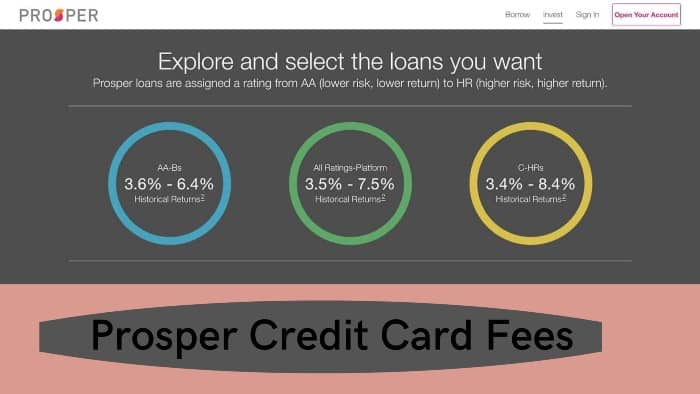

What Is The Prosper Fees Structure?

It is important to note that there is an installation fee. There are fees associated with your loan that is deducted from the total amount borrowed before being deposited into your account. Based on the total amount that you intend to borrow, this percentage will be computed. It does not take into account the total amount of all the loans that you’re going to borrow. A commission will be charged, which varies from 1% to 5% depending on the type of loan.

In this example, origination fees are used to illustrate their effect on the transaction. It is necessary to add 5% processing fee to each Prosper Credit Card loan request for a sum of $10,000. You must pay it on the day of the loan.

- When the money arrives, your account will have a total of $9,500. It is necessary for the borrower to pay a $500 processing fee upon receiving the loan in order to receive the loan.

- Your first bill will likely be a total of $10,000 plus interest accrued in the meantime.

- There is a check fee of $5 or 5% (whichever is less) per payment, which will also be charged if you pay your monthly bill by check.

Finally, late payment results in a fine of $15 or 5% of the unpaid amount, whichever is greater.

The good news is that Prosper does not charge a prepayment penalty if you prepay the loan. The bad news is that this is the only thing Prospero doesn’t get paid for, or so it seems.